TA: Bitcoin Corrects, Why 100 SMA Could Trigger Another Leg Lower

Bitcoin price started a downside correction below the $23,000 support against the US Dollar. BTC is likely to decline again as long as it is below $23,500 and the 100 hourly SMA.

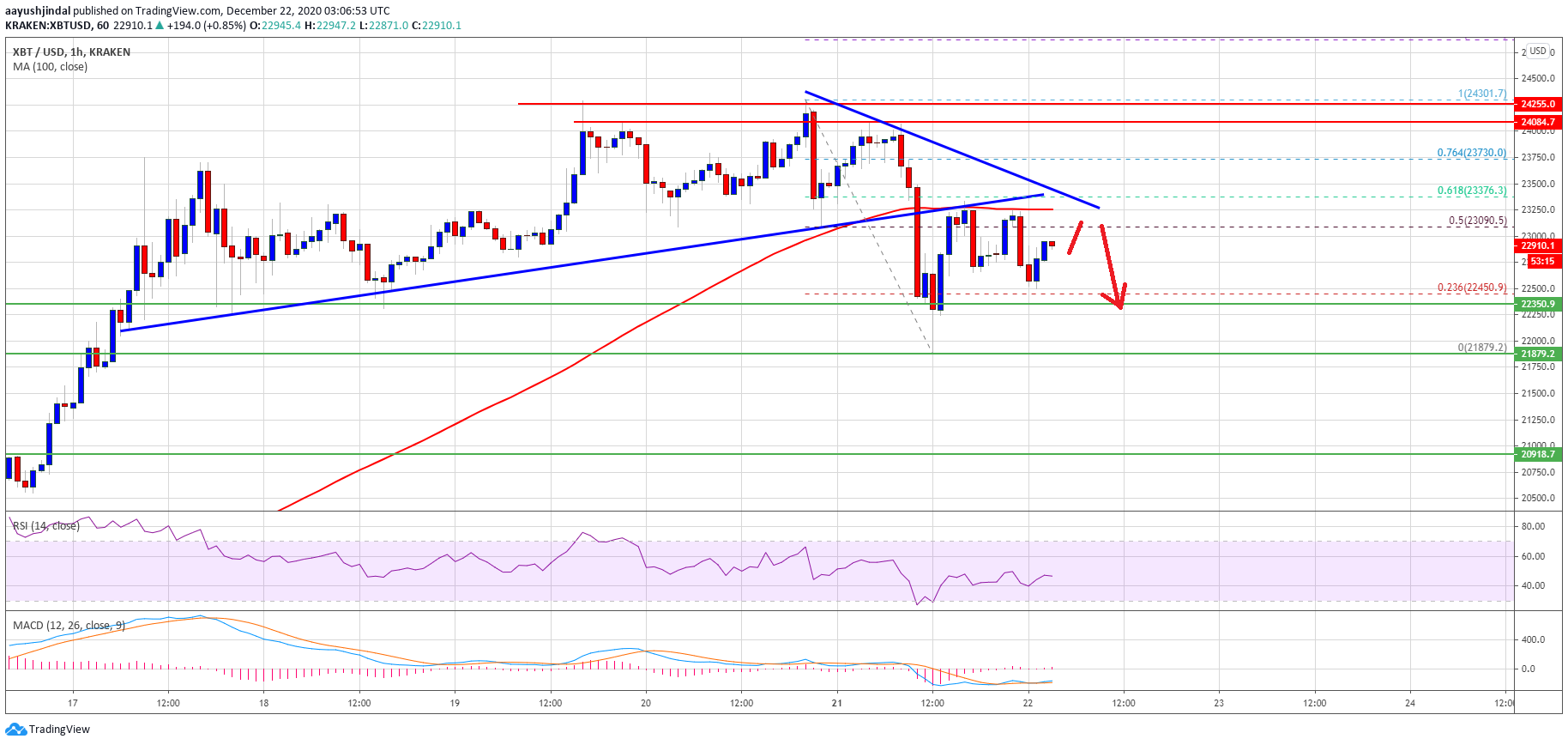

- Bitcoin started a fresh correction and traded below the $23,500 and 23,200 support levels.

- The price is currently trading well below $23,500 and the 100 hourly simple moving average.

- There was a break below a major bullish trend line with support near $23,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is likely to continue lower unless it clears $23,500 and the 100 hourly SMA.

Bitcoin Price is Correcting Gains

After yet another failure near $24,000, bitcoin price started a downside correction. BTC traded below the $23,500 and 23,200 support levels to move into a short-term bearish zone.

The price even declined below $22,500 and settled below the 100 hourly simple moving average. There was also a break below a major bullish trend line with support near $23,250 on the hourly chart of the BTC/USD pair. A low was formed near $21,879 before the price started a strong recovery.

Bitcoin climbed above the $22,000 and $22,200 levels. It even spiked above the 50% Fib retracement level of the recent decline from the $24,300 swing high to $21,879 low.

Source: BTCUSD on TradingView.com

However, the bulls struggled to surpass the $23,200 resistance level and the broken trend line. The 100 hourly simple moving average is also acting as a strong resistance near $23,400. More importantly, there is a connecting bearish trend line forming with resistance near $23,400.

The trend line is close to the 61.8% Fib retracement level of the recent decline from the $24,300 swing high to $21,879 low. A close above the trend line resistance, 100 hourly SMA, and $23,500 could open the doors for a fresh surge towards $24,000 and $24,300.

More Downsides in BTC?

If bitcoin fails to surpass the 100 hourly SMA and $23,500, it could start another decline. An initial support on the downside is near the $22,500 level.

The first key support is near the $22,200 level. The main support is forming near the $22,000 level, below which there is a risk of a drop towards the $21,000 zone in the near term.

Technical indicators:

Hourly MACD – The MACD is struggling to move into the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently just below the 50 level.

Major Support Levels – $22,200, followed by $22,000.

Major Resistance Levels – $23,000, $23,200 and $23,500.

OhNoCrypto

via https://www.ohnocrypto.com

Aayush Jindal, @KhareemSudlow