RAMP DeFi Leads The Liquid Staking Race, Opening Ethereum-Based DeFi to Staked Liquidity From Other Blockchains

Participation in the DeFi and staking ecosystems has seen explosive growth over the last year, with the combined sectors currently accounting for over $50 billion in value.

DeFi growth was predominantly fueled by the breakthrough success of Ethereum-based projects such as Aave, Compound, and Uniswap, utilizing ERC20 stablecoins like USDC and Dai to generate yield. Digital assets staked on other networks were left behind, unable to participate in the emerging DeFi ecosystem.

If those stakers wanted to access DeFi without introducing new capital, they needed to unstake and sell their investments to enter the market. That meant giving up on potential capital gains and staking rewards from those assets.

Singapore startup RAMP DeFi is now pioneering an alternative solution, opening up participation in the Ethereum-based DeFi ecosystem – without giving up the future benefits of other staked digital assets. It has attracted investment from Alameda Research, IOST, and Blockwater Capital, among others.

A Cross-Chain Liquidity On/Off Ramp

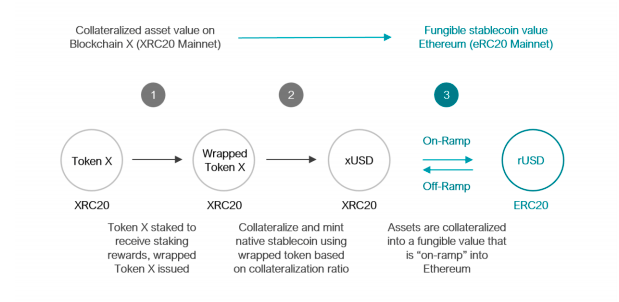

RAMP DeFi’s innovative decentralized protocol solution proposes that capital staked on non-Ethereum blockchains can be collateralized into a new stablecoin “rUSD” issued on Ethereum, acting as a bridge between non-ERC20 tokens and the Ethereum chain.

By lending/borrowing, bootstrapping stablecoin liquidity, and integrating with other DeFi solutions, rUSD holders can either deploy rUSD into higher yield generating opportunities or swap into USDT/USDC. This creates a seamless on/off ramp for users with staked capital on other chains to access DeFi without giving up future potential gains or rewards from the collateralized digital assets.

How Does It Work?

For each blockchain “X” integrated, a RAMP staking node and smart contract on blockchain X are set up to manage the assets. Token X is staked in the RAMP ecosystem to continue to receive blockchain X staking rewards.

A Wrapped Token X is then issued and used to collateralize and mint a blockchain X native stablecoin, xUSD. xUSD is based on a collateralization ratio similar to MakerDAO.

xUSD can then be swapped into the ERC20 rUSD stablecoin, using the on/off ramp cross-chain bridge. From there, rUSD can be deployed into yield farming opportunities or swapped directly for other stablecoins using decentralized liquidity pools.

A Broadening Ecosystem That’s Gaining Traction

RAMP DeFi’s liquid staking solution opens up an ecosystem of services, assets, and opportunities that is already beginning to gain traction:

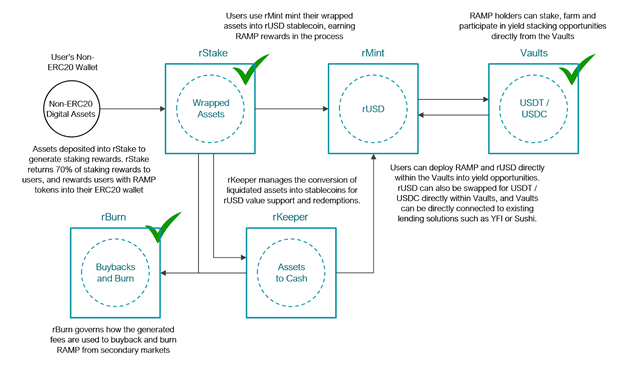

rStake

rStake is the part of the ecosystem where non-ERC20 tokens are staked and wrapped tokens are issued to represent the ownership of the underlying assets. It is an aggregator of staking nodes on the participating blockchains, returning 70% of the staking rewards to the user, incentivizing participation through additional RAMP governance token rewards. The remaining staking rewards generate fees for the RAMP ecosystem to help with stability.

rStake has already launched integrations for the IOST, TomoChain, and Tezos blockchains.

rMint

rMint uses the wrapped tokens issued by rStake as collateral to mint a stablecoin for the respective X blockchain (xUSD). xUSD is then swapped into ERC20 rUSD to use in the Ethereum DeFi ecosystem, earning RAMP rewards in the process.

Early adopters include Elrond, NULS, and Solana for cross-chain DeFi farming.

Vaults

The Vaults utility platform for RAMP and rUSD allows holders to stake, farm, and participate in yield stacking opportunities.

rUSD can also be swapped for USDT/USDC directly, and Vaults can connect to existing solutions such as YFI, Uniswap, or Sushi.

rKeeper

rKeeper manages the conversion of liquidated assets into stablecoins for rUSD where necessary for value support or redemptions. rKeeper converts the value of liquidated assets into USDT/USDC at the equivalent rUSD originally minted.

The repurchase of rUSD by rKeeper only takes place when rUSD is less than 1:1 with USDT/USDC, creating stability for rUSD utility.

rBurn

The fees generated by rStake are used to buy back and burn RAMP, removing tokens from circulation. rBurn is designed as a “smart burn” mechanism that again helps provide stability for rUSD as an alternative stable coin and bridge to the Ethereum-based DeFi network.

Opening Up Defi To Non-ERC20 Tokens

RAMP DeFi introduces a solution with the potential to unlock over $30 billion in a previously illiquid staked digital asset sector, set to expand fourfold with the transition to Ethereum 2.0 alone.

The RAMP ecosystem represents exciting growth potential for DeFi, harnessing existing success while opening up further possibilities for ERC20 and non-ERC20 tokens to gain access to additional yield generating services. It frictionlessly connects a range of digital assets to the decentralized finance marketplace, across an increasingly interoperable space, boosting DeFi adoption as a result.

Image by WorldSpectrum from Pixabay

OhNoCrypto

via https://www.ohnocrypto.com

Thomas Delahunty, @KhareemSudlow