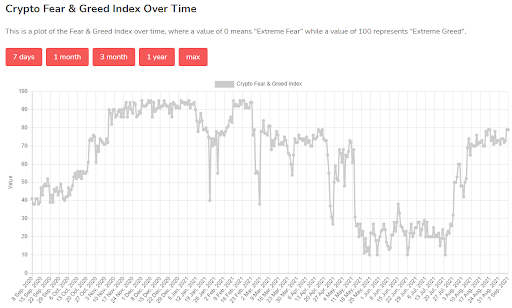

Crypto “Fear and Greed” Index

There are three primary drivers behind any type of market where trading occurs.

Whether stocks, bonds, precious metals, commodities, or cryptocurrencies – they’re all impacted by these three factors:

Fundamentals

These are the macroeconomic conditions in which the market exists, which provide shape and context for that market. The conditions are dynamic and can change quickly or slowly over time. Examples include elections, wars, natural disasters, and economic factors such as inflation, reckless government spending, and runaway money printing.

Technicals

Markets are made up of people, and people are creatures of habits. As each of us engage in the behaviors of buying, selling, and holding assets individually, larger behavioral patterns form on an aggregated scale that reflect the collective actions. While no one can predict the future market movements perfectly, these technical patterns can inform decisions about what’s likely to happen next and the best course of action to take for the highest probability of success.

Sentiment

Not only are people creatures of habit, they are creatures of emotions. Arguably, very few people have the discipline and determined will to buy, sell, and hold in a market based solely on pure logic. People tend to rely on their “gut instincts” or pure emotions. Anyone who doubts the role that emotions play in markets and decision-making need only recall this quote by famous economist John Maynard Keynes:

“The markets can remain irrational longer than you can remain solvent.”

It’s because of this third emotionally-driven element of the market that software developers Gregor Krambs and Victor Tobies conceived and created the Crypto Fear & Greed Index (FGI).

The FGI, is a free, easy-to-understand, interactive dashboard that provides a daily snapshot of the general market sentiment based on a variety of weighted factors that include: volatility, market volumen, social media, dominance, and trends.

The software automatically scrapes the Internet and updates these factors every 24 hours.

The algorithm then calculates the FGI score for the day, and then plots it on a 0-100 scale with 0-50 representing varying degrees of Fear and 50-100 representing varying degrees of Greed.

Here you can see the current Fear & Greed Index.

As described per CNN Business, the crypto market behaviour is very emotional.

People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in the irrational reaction of seeing red numbers. With our Fear and Greed Index, we try to save you from your own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, we analyze the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear,” while 100 means “Extreme Greed.”

Another interesting feature of the FGI website is that you can look back historically and see the trend line swings overtime. It’s helpful to do that and correlate the line’s movement with specific fundamental and technical events.

You can look at the timeline over the past seven days, month, three months, year, and the “max” view which dates back to the creation of the FGI in early 2018. This chart looks at the past year.

The FGI is a useful tool, and single data point, to help hodlers and traders alike evaluate the crypto markets with a bit less emotion and a bit more understanding during times of uncertainty.

On The Flipside

- Any market model, whether it’s the “stock-to-flow” or “Pi Cycle Top Indicator” is only as good as its inputs.

- All models should be considered with a grain of salt and should only be used as another data point to reference – not the sole reason for buying or selling any asset.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7]

You can always unsubscribe with just 1 click.

Op-ed, crypto market, Cryptocurrency, Fear and Greed IndexRead More

OhNoCrypto

via https://www.ohnocrypto.com

, Khareem Sudlow