Crypto Flipsider News – September 8th – Oil Prices Drop, Followed by Crypto Crash, the SEC Threatens to Sue Coinbase, Shares Drop, Germany Investment Funds, and Crypto Volatility

Read in the Digest

- Oil Prices Drop, Followed by Crypto Crash

- Outages Lead to Drop in Coinbase Shares, the SEC Threatens Lawsuit

- Germany to Introduce Tokenized Mutual Fund Shares

- El Salvador Highlights Crypto Volatility Once Again

Oil Prices Drop, Followed by Crypto Crash

Once again, the spotlight was on the crypto market after nearly $240 billion in value was wiped from the market cap. However, before the sharp plunge of the crypto market, crude prices experienced a significant decline over the weekend.

U.S. West Texas Intermediate crude traded at $67.64 per barrel, while Brent crude futures settled at $71.69 after falling 39 cents on Monday. The drop has been linked to Asia’s fading demand in crude while the dollar strengthens.

In March, there was a similar incident when Brent crude futures plummeted 30% to $31.02 per barrel. Following the drop, the price of Bitcoin fell by more than 10%, with the entire crypto market losing $24 billion in 24 hours.

Flipsider:

- While the massive decline of the crypto market is far from desired, the crypto industry still celebrates the approval of Bitcoin as a legal tender in El Salvador.

Why You Should Care

The seeming correlation between the price of oil and the crypto market means that cryptocurrencies are not just imaginative assets with no “intrinsic value,” as some have opined. Instead, it goes to show that there is a relationship between cryptos and other asset classes.

Outages Lead to Drop in Coinbase Shares, the SEC Threatens Lawsuit

Leading crypto exchange Coinbase has been hit with a barrage of roadblocks, leading to the drop in its share prices. Shares of Coinbase fell as much as 6% on Tuesday amid an ongoing service outage.

According to an official statement from Coinbase, “a sudden increase in network traffic and market activity” led to a “degradation in our services.” As a result, several transactions were delayed or cancelled on the network.

Before the outages hit, the Securities and Exchange Commission (SEC) threatened to sue Coinbase over a yet-to-be-launched crypto yield program it considers a security.

The program, Lend, aims to provide eligible customers verified borrowers with a 4% annualized percentage yield by lending out USD Coin (USDC). However, Coinbase reported that “if we launch Lend, they intend to sue.”

In reaction, the CEO of Coinbase, Brian Armstrong, tweeted;

1/ Some really sketchy behavior coming out of the SEC recently.

Story time…— Brian Armstrong (@brian_armstrong) September 8, 2021

Flipsider:

- Shortly after the outages, Coinbase said in a tweet that it resolved the issues related to its service outages

- Furthermore, the losses have been pared to about 4% as of the time of publication

Why You Should Care

Coinbase is one of the biggest cryptocurrency exchanges today, with approximately 68 million verified users. A regulatory battle with Binance has already resulted in the restriction of some of its services in certain regions. We hope regulations do not force Coinbase into doing the same.

Germany to Introduce Tokenized Mutual Fund Shares

As the utilization and adoption of crypto increases, we have seen new use cases for digital assets from around the world. Germany has announced its plans to introduce tokenized mutual fund shares.

To improve the efficiency of the tokenized mutual fund shares, the German Federal Ministry of Finance launched a public consultation to gather feedback about the introduction of tokenized mutual fund shares. The public will be able to submit comments until October 1st, 2021.

In addition, institutionally oriented funds in Germany can now invest up to 20% of their total holdings into crypto. Taking the initiative, Union Investment, with $437 billion in asset management, announced that it would add Bitcoin to various funds.

Flipsider:

- While countries are warming up to cryptocurrencies, China has intensified its crackdown on the industry in 2021

- The People’s Bank of China (PBoC) referred to cryptos as speculative assets

Why You Should Care

Germany’s move to introduce tokenized mutual funds shows that blockchain and cryptocurrencies are steadily veering towards legitimacy worldwide. It is only a matter of time before the asset class becomes as accepted as fiat currencies.

El Salvador Highlights Crypto Volatility Once Again

Following what can be described as one of the biggest wins for the crypto industry, volatility, the long-standing bane of the cryptos, rears its head once again.

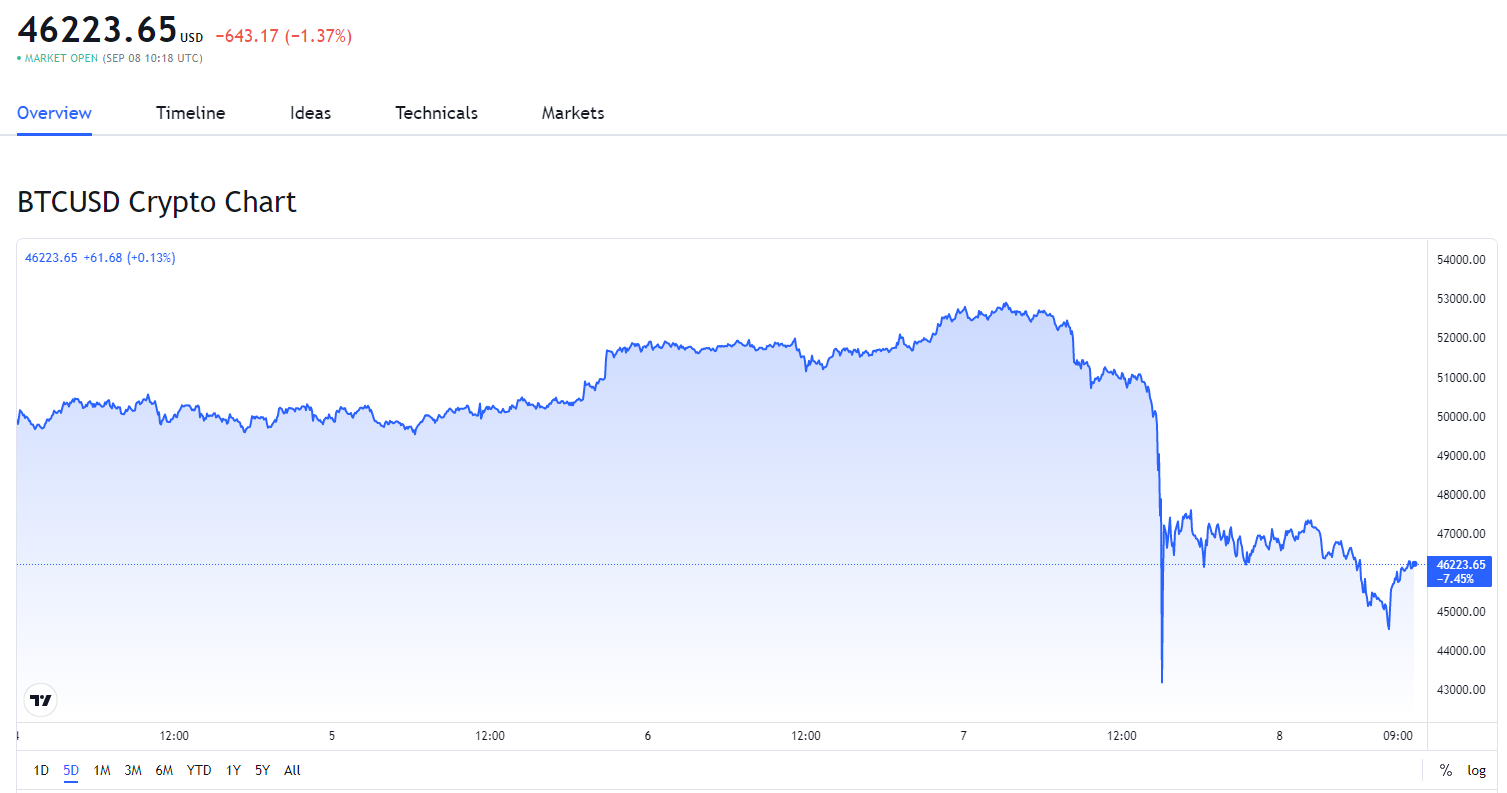

On the day when Bitcoin became the legal tender of a country, the crypto market was hit with a sharp downtrend. Hours after El Salvador announced that it had become the first country to purchase Bitcoin officially, the price of BTC fell more than 10%.

The five-day price chart of Bitcoin (BTC). Source: TradingView

Bitcoin is not the only crypto to suffer from the crash. The top 20 cryptos by market cap are all experiencing downtrends. The biggest loser is Internet Computer (ICP), down by 19% in the last 24 hours. In all, nearly $240B has been wiped from the crypto market since the El Salvador announcement.

Flipsider:

- Regardless of the volatility of crypto assets, El Salvador and many others still believe cryptocurrencies are the future of finance

- El Salvador backed its stance by purchasing 400 Bitcoins

Why You Should Care

While the volatility issue still remains, it doesn’t take anything away from the colossal milestone reached by cryptos. Bitcoin Day, or “B-day,” as locals have dubbed it, ushers the world into an era where residents of the country can buy breakfast and pay utility bills or taxes in Bitcoin.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7]

You can always unsubscribe with just 1 click.

Market News, and Crypto Volatility, Followed by Crypto Crash, Germany Investment Funds, Oil Prices Drop, Shares Drop, the SEC Threatens to Sue CoinbaseRead More

OhNoCrypto

via https://www.ohnocrypto.com

, @KhareemSudlow