Now Might be the Perfect Time to Buy for Crypto Contrarians

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.”

― Warren Buffett

Billionaire investor, Warren Buffet is famously called the greatest investor of all time. One of his top wealth-generating strategies is to be greedy when the rest of the markets are fearful. If you’re in crypto and like that philosophy, now would be the perfect time to buy.

That’s because the crypto markets are currently in “extreme fear,” according to the Crypto Fear & Greed Index (FGI), a free interactive dashboard that’s updated daily to provide the general market sentiment based on a variety of weighted factors.

The algorithm calculates the FGI score each day, and then plots it on a 0-100 scale with 0-50 representing varying degrees of Fear and 50-100 representing varying degrees of Greed. Per the graph below, the FGI states that sentiment is extremely fearful, and it hasn’t been this low in nearly four months.

Interestingly, the right hand side of the graphic shows that just a few weeks ago sentiment was more than triple the current number and was in the “extreme greed” range. That was a day before the flash crash that shook out both short-and-long leverage traders from the market at the beginning of September.

Conversely, the current sentiment provides a good entry point for contrarian investors who can scoop up several top-10 crypto assets by market cap that are trading at discounts.

Contrarian investing is the strategy of moving in the opposite direction of the dominant sentiment or market trend – basically zigging when everyone else is zagging. The basis for this particular investment style is grounded on the principle that markets move up or down based on the emotional movements of fear and greed driven by the herd of retail and smaller institutional investors.

This buying opportunity was specifically addressed in the weekly forecasting newsletter from on-chain analyst and crypto influencer, Willy Woo, which he attributed to FUD in the stock market and declines in the China real estate market following the collapse of the China Evergrande Group in recent weeks.

“Investors continue to buy, unfazed by the equities sell-off. A divergence between bearish price action and bullish investor demand implies a bullish supply squeeze will happen sooner or later. Despite the locally bearish price action, the forecast is unchanged from the last letter. I expect a bullish move to explore the $50k-$60k price range over the next 2 weeks,”

wrote Woo.

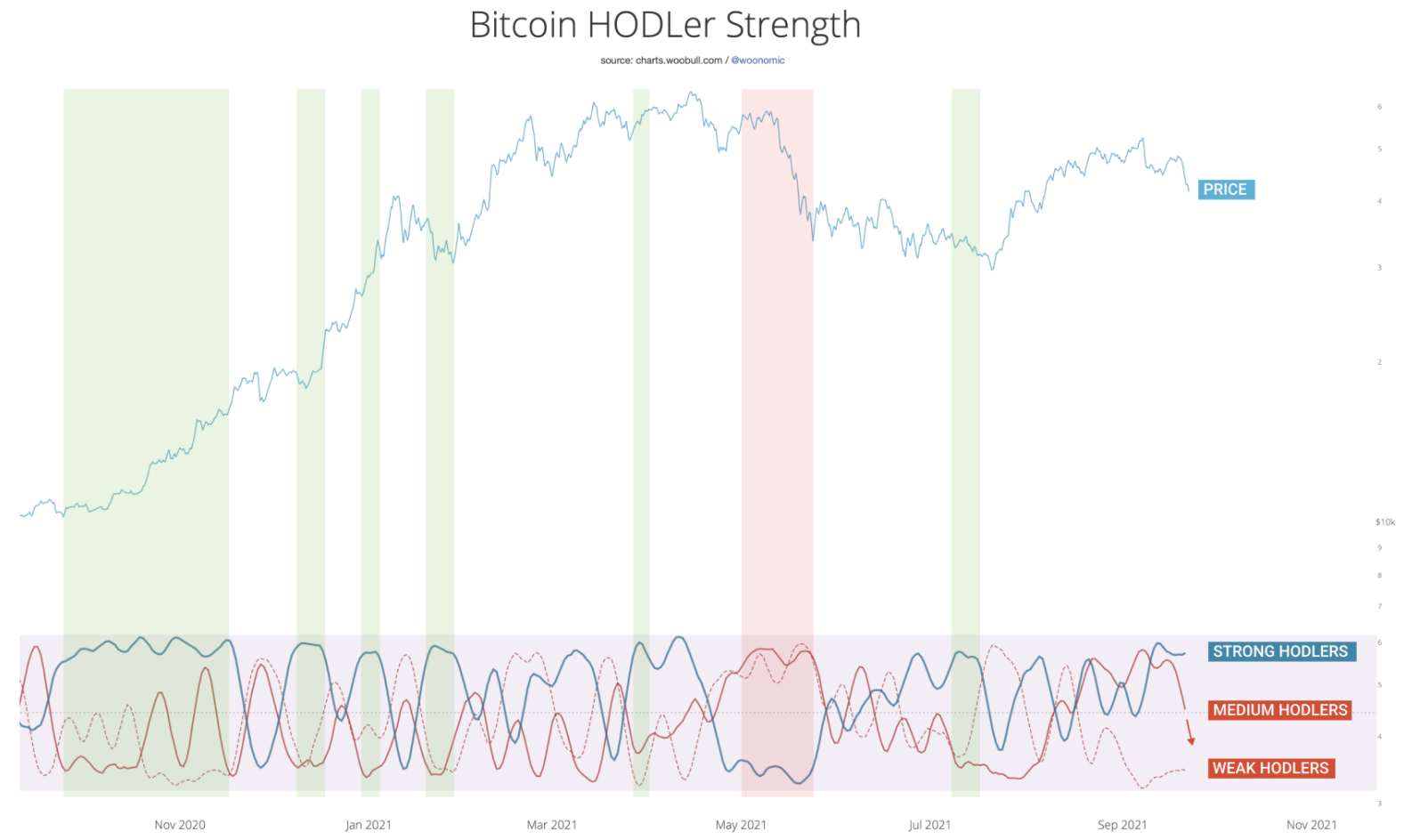

One of the reasons for Woo’s optimism is this chart he created that classifies Bitcoin HODLers into three distinct groups – strong, medium, and weak. He then follows the ebb and flow of their respective “strength” as coins move between each group – as depicted in the extremely wavy three-line graph along the bottom of the chart. Woo believes the conditions are perfectly aligned for a strong rally to happen because strong HODLers are peaking collectively, while medium and weak HODLers are fading.

“As we can see in this chart, the current setup is moving into this structure, which furthers our case for a bullish rally developing,”

wrote Woo.

On The Flipside

- Whether it’s the “stock-to-flow” or “Pi Cycle Top Indicator,” or a proprietary model developed by Willy Woo, an investing model is only as good as its data inputs.

- All models should be considered only as another reference data point.

- No market model should be used to make selling or buying decisions in a vacuum.

Why You Should Care?

There are three primary drivers behind any type of market where trading occurs: fundamentals, technicals, and sentiment. The first two factors tend to be quantitatively driven, while the last one is more qualitative. No matter how the markets are moving, it’s critically important to remain calm and collected, making logical decisions based on data rather than irrational decisions driven by emotion.

EMAIL NEWSLETTER

Join to get the flipside of crypto

Upgrade your inbox and get our DailyCoin editors’ picks 1x a week delivered straight to your inbox.

[contact-form-7]

You can always unsubscribe with just 1 click.

Analytical, crypto, Fear and Greed Index, Warren BuffetRead More

OhNoCrypto

via https://www.ohnocrypto.com

, Khareem Sudlow