Current Bitcoin Rally Driven by Whales, No Big Short Positions Liquidated Yet: Analyst

Bitcoin’s price rallied to $60K today for the first time since April. The CEO of a well-known data analytics company revealed that the move has been driven largely by whales and that there haven’t been any big short liquidations yet.

This is a Whales World

Bitcoin touched $60K for the first time since April 18th today. Zooming out shows a considerable rally. The cryptocurrency is up 25% in the past 30 days. It’s also up 100% since the sub-$30K crash in July.

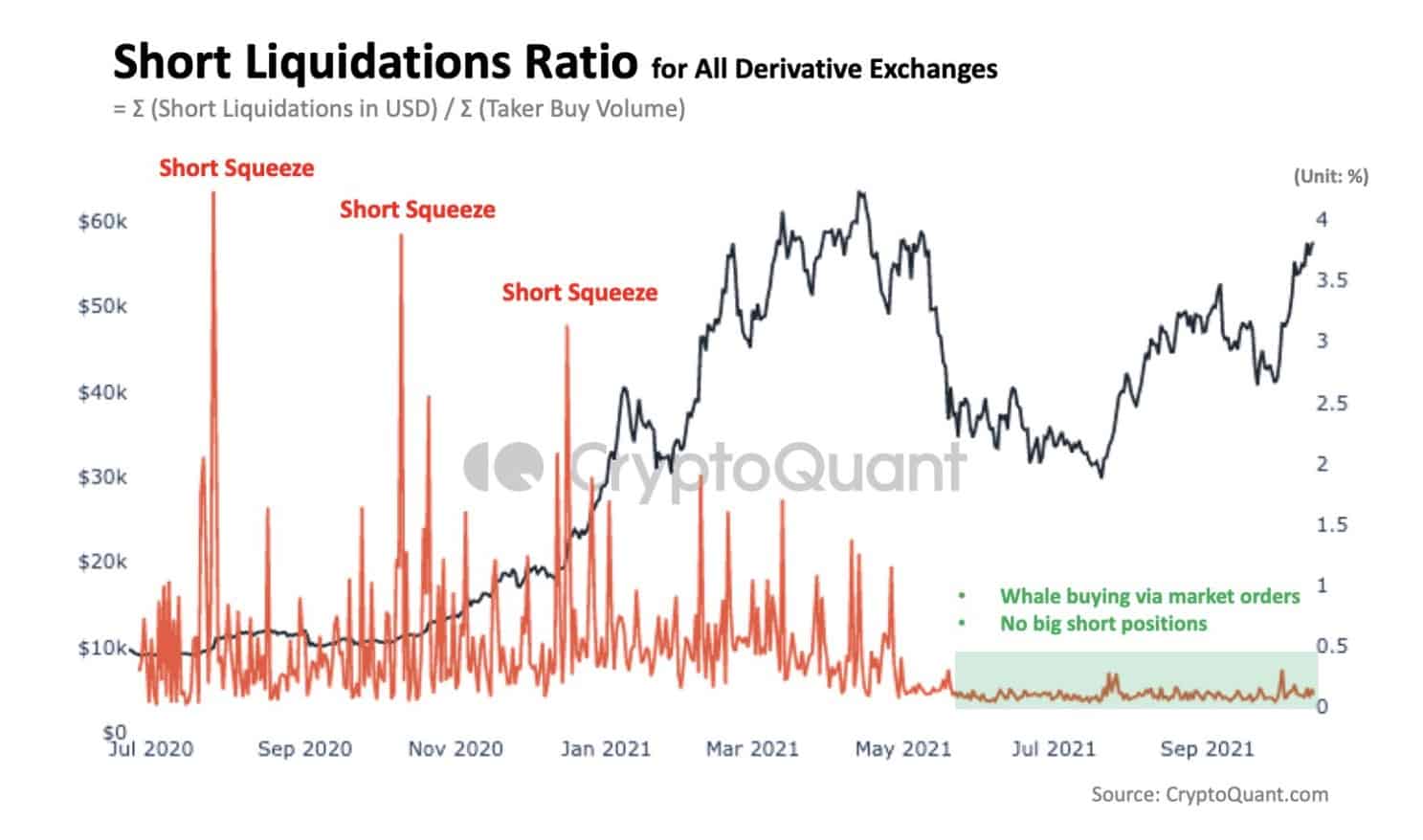

Commenting on the matter was Ki Young Ju, the CEO of CryptoQuant – a well-known data analytics and research company in the industry. He outlined that the rally was driven mainly by whales and that we haven’t seen “big short positions liquidated so far.”

This rally has been driven by whale buying, not short squeeze.

Massive BTC buying market orders in derivative exchanges are not from short liquidations.

This indicates:

1/ There are no big short positions liquidated so far,

2/ Whales punted long positions since the dip.

To clarify, a short squeeze is an event where the price of an asset goes higher exponentially because as leveraged short positions are getting liquidated (squeezed). This creates a snowball effect where the higher the price goes, the more shorts get wiped off, boosting the price even more.

Looking beyond the above, the fact that there are no major liquidations on short positions might also have other implications. Data from Bybt reveals that in the past 24 hours, $150 million worth of shorts were wiped off, which, indeed, is not so significant.

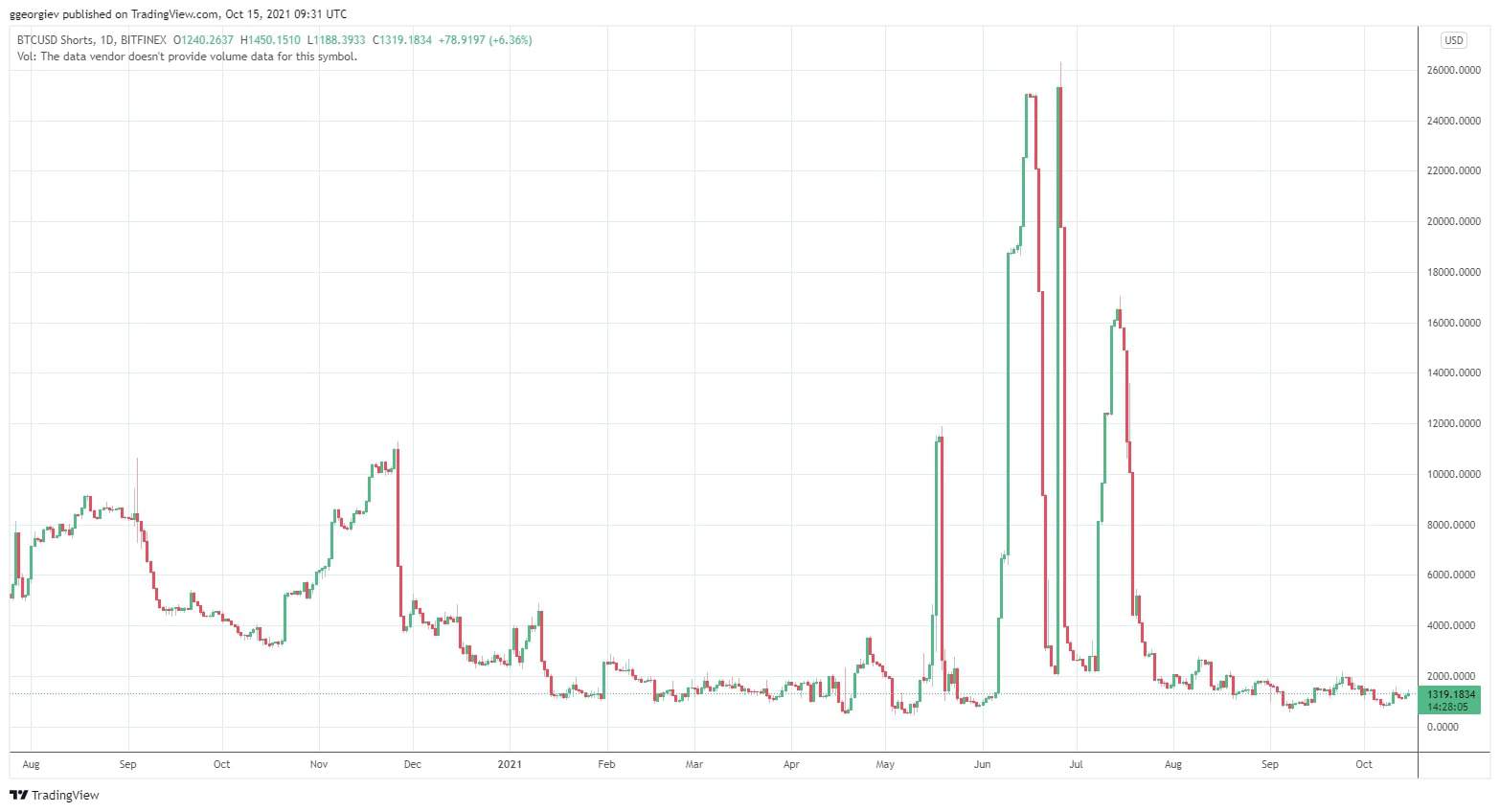

The below chart reveals the number of Bitcoin shorts on Bitfinex.

It could also suggest that there’s confidence in the current rally. Given that there’s no considerable pressure coming from on-chain metrics, this could further validate the run and perhaps propel it even higher.

HODLers Gonna HODL

As CryptoPotato recently reported, over 85% of Bitcoin’s total circulating supply hasn’t moved in more than three months. This means that HODLers have confidence in the cryptocurrency and don’t show any signs of selling just yet.

In our most recent Bitcoin price analysis, we spoke of the currently available on-chain information and what it means for BTC in the near and mid-term future.

There have been signs of light distribution as the price reaches these multi-month highs, but this is expected, and we’ve discussed it at length in our previous analyses. It could pose some slight challenges in the immediate short-term as investors who bought between the $55K – $58K range might be looking to break even.

Yet, it’s important to note that on-chain metrics remain firmly bullish as most of the HODLers groups continue accumulating.

OhNoRipple via https://www.ohnocrypto.com/ @George Georgiev, @Khareem Sudlow