Wash Trading in the NFT Space: The Problem and Possible Solutions

The boom of the NFT industry in the last year has been extremely lucrative for many actors flocking into this fast-growing ecosystem. However, history tells us that when there is money involved, there are potential scams and tricks as well.

And, unfortunately, the space of non-fungible tokens (NFTs) is no exception, with many people trying to manipulate the price and value of the digital assets through what is known as wash trading.

Wash Trading is a traditional term used in finance, which refers to the process of buying and selling assets to create a misleading market signal. In the crypto ecosystem, it is done by trading assets for the sake of creating an illusion of liquidity and manipulating the market value. Recently, Bloomberg and other publications have documented wash trades in NFT that require the immediate attention of the entire community.

In wash trading, the scammers participate in the following trends to manipulate the industry:

- Purchasing an item to stimulate artificial demand for the project.

- Buying assets or rights to create publicity for the artist.

- Artificially inflating metrics by purchasing and selling assets.

- Collecting rewards using assets that are more valuable than the cost-of-attack.

These practices have created an unsafe and unfair environment for investors and collectors.

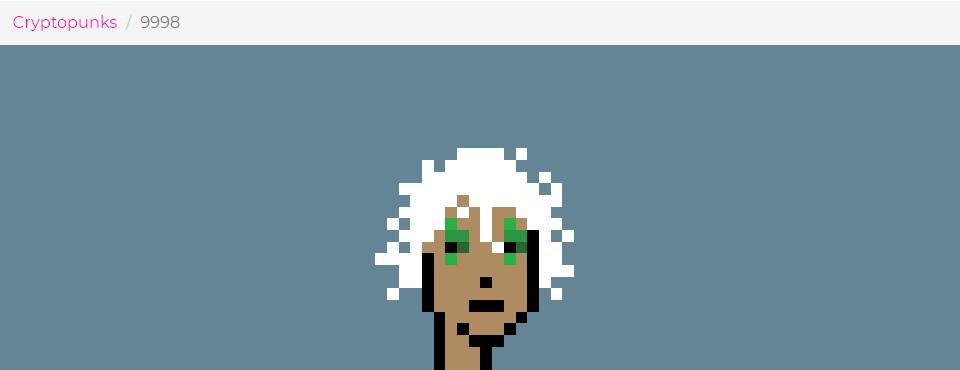

The CryptoPunk 9998 Case

Recently, a new report emerged where scammers engaged in NFT wash trading for an NFT by CryptoPunk for the whopping value of $532 Million. The NFT in discussion is a white-haired, green-eyed pixelated character sold for over half a billion dollars.

However, the Ethereum blockchain shows that the money from the trade ended up in the initial account soon after the trade, meaning that the sellers sold the NFT to themselves for half a billion dollars.

The Outcome of Wash Trading

When someone inflates the value of their digital assets, they gain the ability to sell their digital assets for a price that is highly overinflated. For example, if someone sees an NFT selling for $100,000, and that same NFT is going on sale for $10,000, they probably would think they are buying the digital asset for a huge bargain.

Meanwhile, in the back end, someone just sold the NFT to themselves for $100k, for an asset that probably is completely worthless. In such cases, an individual would be spending way too much money for something that was deemed worthless before the wash trading.

The Solution

Unfortunately, at this time, the only solution for people to avoid becoming victims of wash trading is through authentication of the transactions registered on the blockchain. This is a long process that most people will definitely not do, as the majority do not have the bandwidth or experience to take those extra steps.

However, we are seeing projects that aim to aggregate and organize data in a much more seamless fashion, which will hopefully filter out all the malicious activities.

Ludo is a metasearch engine and data aggregator that aims to solve this problem through data aggregation and validation. This way, people are much more protected from malicious activities like wash trading. There will be a universal tool used to check the right boxes, all done seamlessly through a positive user interface and experience.

Ludo offers a central gateway to a multi-chain web 3.0 to serve the NFT industry. The project provides a search engine, showcases NFTs, creator tools, P2E tools, GameFi dashboard, and more.

As an ESG mindful platform, Ludo is building the necessary checks and balances to minimize and mitigate the risks users may face when interacting in the NFT ecosystem.

OhNoRipple via https://www.ohnocrypto.com/ @Danish Yasin, @Khareem Sudlow