Ethereum Price Analysis: Is ETH Due for a Correction Following 15% Weekly Gains?

Positive momentum has been setting foot over the last 48 hours, and ETH is no exception – ending this week with a green candle. But the main question is whether the bear market is over or how confident the participants are about the reversal of the downtrend.

Technical Analysis

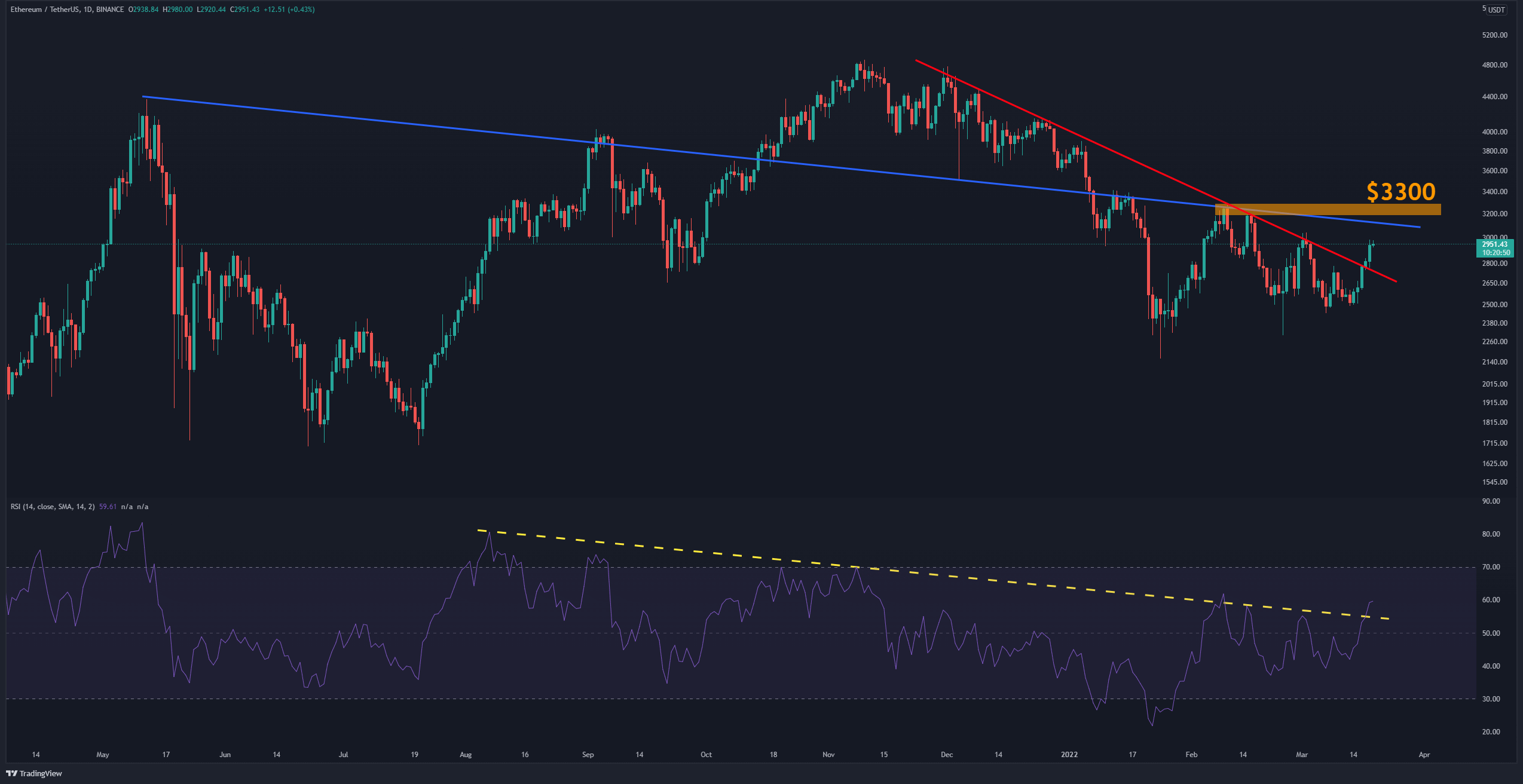

The Daily Chart:

Technical Analysis By Grizzly

Ethereum is forming a very bullish structure on the daily chart. The second-largest cryptocurrency has made a robust weekly green candle as well.

As discussed in the March 17th analysis, confirmation of the reversal of the downtrend would be considered after the price crosses above the static level at $3300. Looking at the weekly candlestick at the end of January, we see that the price fell again despite the 25% surge, and February was all downhill. Technically, by forming a higher high and crossing above the static level at $3300, which is the intersection of many resistances, we can consider a trend reversal with more confidence.

- RSI-14: Crossing the downtrend line and moving in the bullish area

- Resistances levels: $3,000 and $3,300

- Supports levels: $2700 and $2500

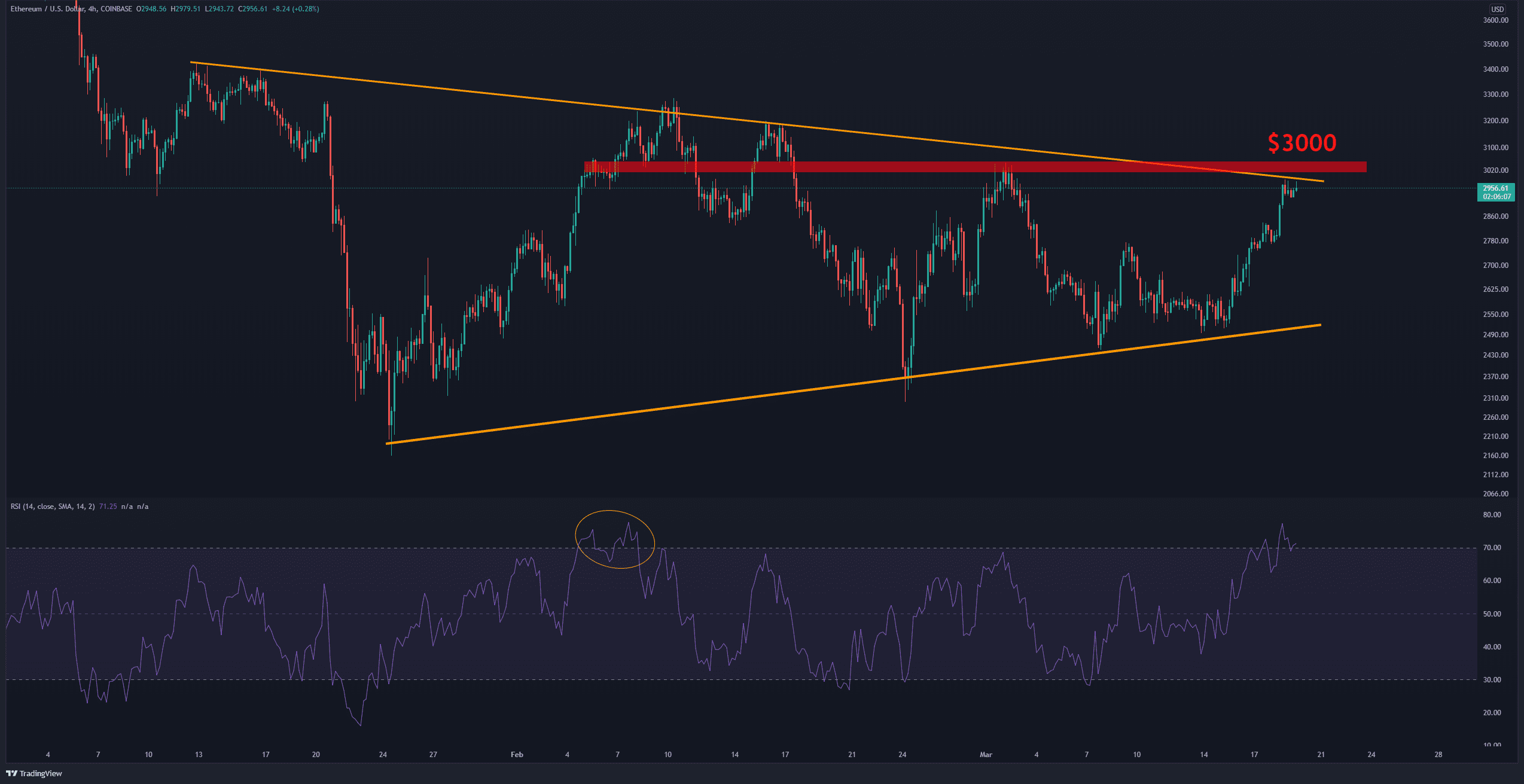

The 4-Hour Chart:

On the 4-hour timeframe, Ethereum is trading inside a triangle since the beginning of 2022. Its upper side acts as dynamic resistance and intersects with the static resistance at $3,000. Looking at the historical trend, the price has started the corrective phase by entering the overbought area in RSI (yellow circle).

OhNoRipple via https://www.ohnocrypto.com/ @CryptoVizArt, @Khareem Sudlow