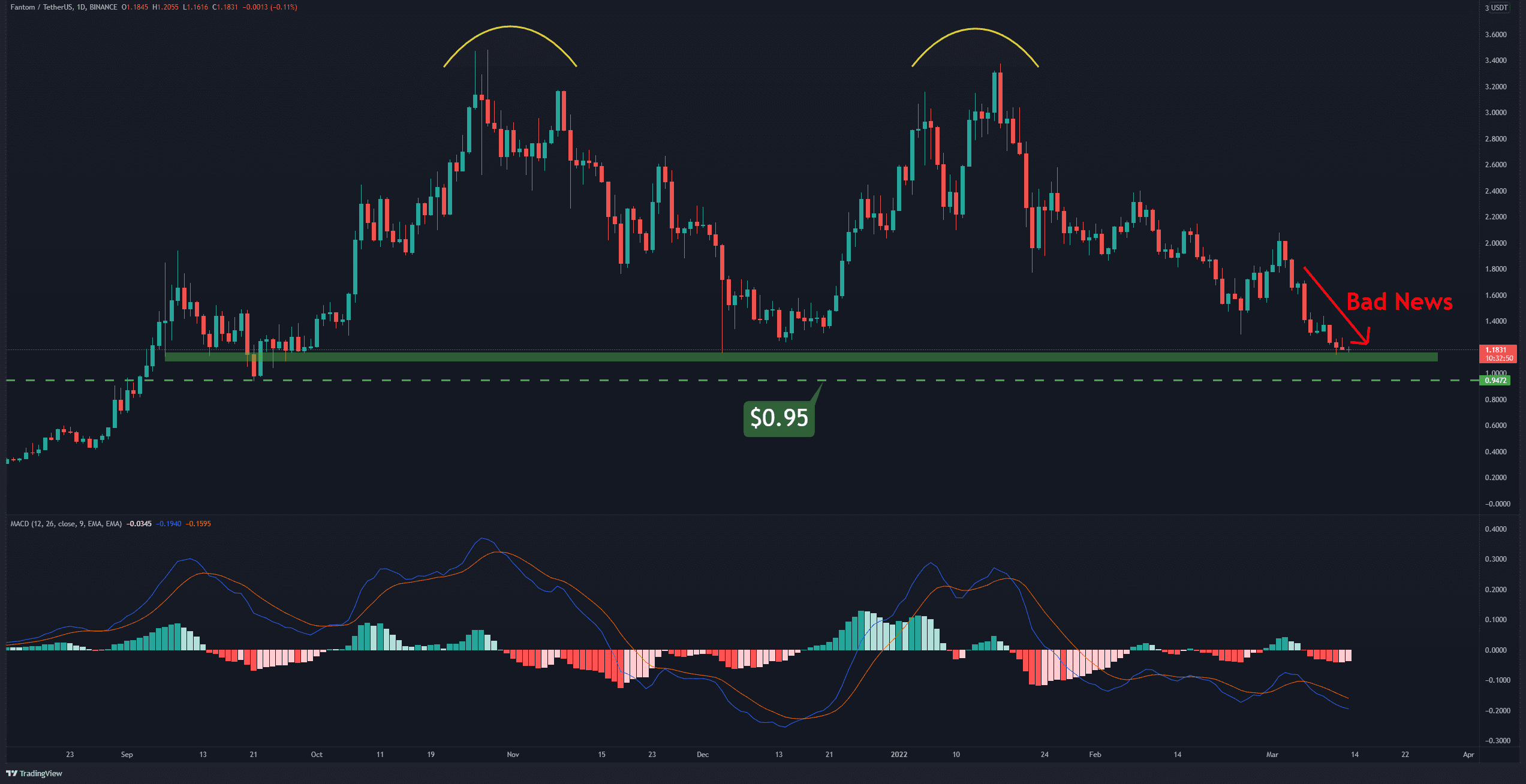

Fantom Price Analysis: After the 30% Weekly Crash, FTM Might Rebound Here

Fantom (FTM) lost 45% over the past ten days and 30% weekly, following the abandonment of its two key developers. FTM is now trading 66% below its all-time high recorded just five months ago.

FTM, which had been very strong during the recent market retracement and even reached back to its ATH levels, experienced a significant collapse as the news was released. As a result, the ongoing price correction was intensified and turned into an additional 45% drop.

The Daily Chart

Technical Analysis by Grizzly

The price of FTM has reached significant horizontal support that slowed down the price collapse a bit. But fear and uncertainty in the crypto and traditional markets have prevented an unusual reaction in this area.

If the correction continues, the next significant support lies at $0.95, which can hold the FTM price in the mid-term for a possible rebound.

The MACD indicator is in the oversold area, and if the market fluctuations do not rise from here, this structure might signal the completion of the intensive price correction.

The 4-Hour Chart

On the lower timeframe, the price moves down inside a falling wedge. The good news is that both the MACD and the RSI are in the oversold area and showed a bullish divergence that might raise the case of a possible price rebound.

The first significant challenge for FTM is to break above the horizontal resistance at $1.5.

OhNoRipple via https://www.ohnocrypto.com/ @CryptoVizArt, @Khareem Sudlow