ETH is About to Lose $3000 – Where is The Next Critical Support? (Ethereum Price Analysis)

The bears took control of the crypto market last week and were able to push the ETH price down 12% since reaching its weekly high above $3500.

The DXY index is increasing, and the news from China regarding COVID19 cases has brought back the fear into the market. The big question is if we wait for the lower levels – below $3K – and whether the March bullish market is over?

The Daily Chart

Technical analysis by Grizzly

In this analysis, we examine the trend using the Volume Delta and Taker Buy/Sell Ratio index, which is related to the order book of derivatives exchange.

On the daily timeframe, ETH is very close to the key support level at $2800 – $3000 (marked green), which has shown an excellent area for a possible trend reversal.

As we can see in the following chart, the recent uptrend has been accompanied by an increase in the strength of buyer takers (marked yellow line) and an increase in volume delta (yellow rectangle).

This shows that price increase is formed when the buyers are more greedy and aggressive than the sellers. In contrast, the downtrend increased the strength of seller takers (marked blue). However, it still does not show an upward sign on the charts. We have to wait and see if greedy buyers will re-enter the market at the key support mentioned above.

If ETH goes below this key level, we can expect the bloodbath to expand. Until then, it is better, as we said in the previous analysis, to avoid emotional decisions and act more cautiously.

Moving Average Levels

MA20: $3277

MA50: $2941

MA100: $2967

MA200: $3489

The 4-Hour Chart

On the 4-hour timeframe, ETH failed to break the MA100 (marked blue) after two attempts, and the price has dropped to MA200 (marked white). Currently, the bulls are trying to hold it. The RSI 14-day indicator is also close to the oversold zone.

As mentioned in the analysis above, the most important thing now is to hold support at $2800 – $3000.

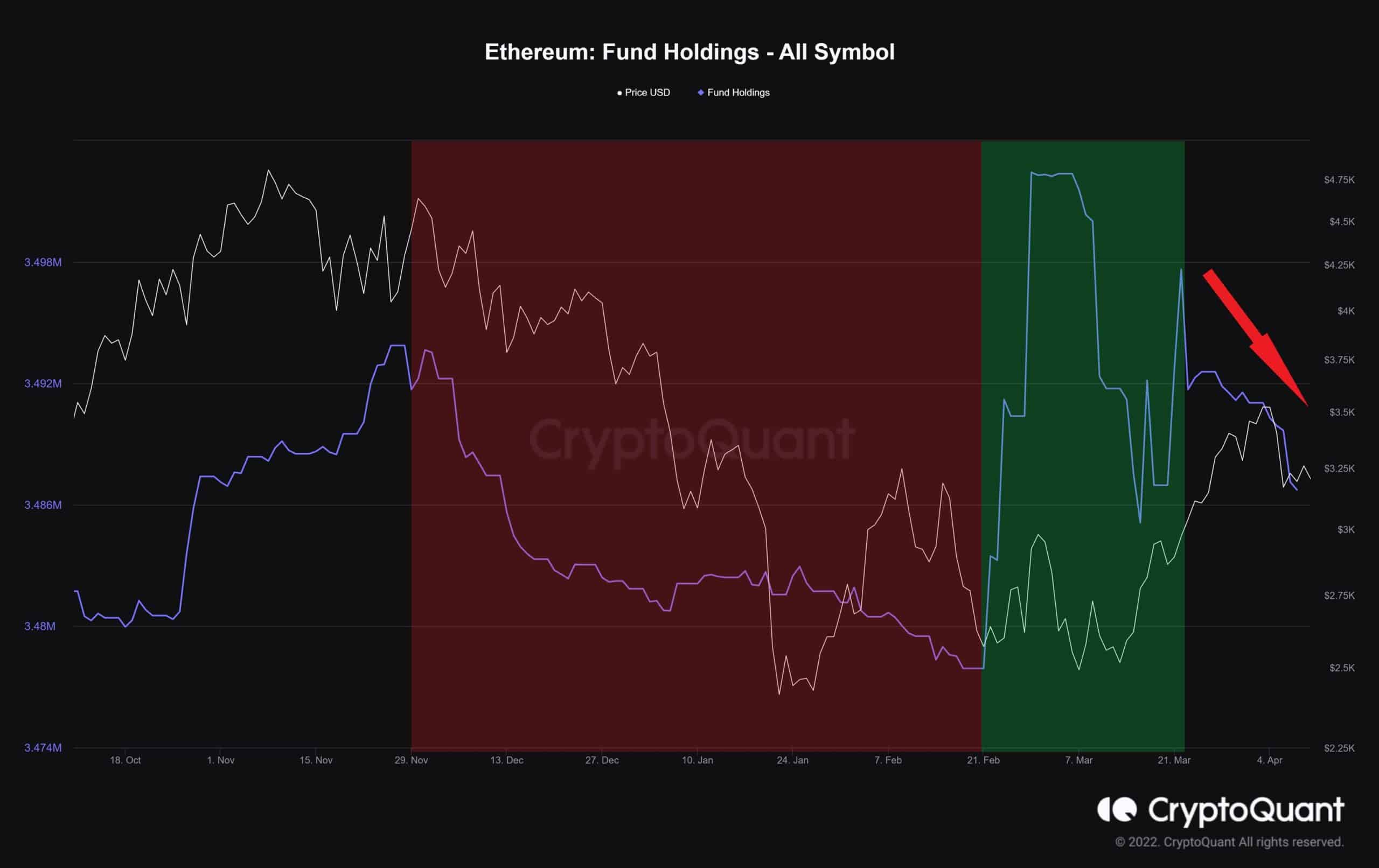

On-chain analysis: Fund Holding

Fund Holing indicates the total amount of coins held by digital assets holdings such as trusts, ETFs, and funds. The amount could increase as demand for indirect investment increases.

Demand for Ethereum by indirect investors has risen in recent months following the price. But now, after the bearish news, they seem to be more cautious, and demand is dropping.

OhNoRipple via https://www.ohnocrypto.com/ @CryptoVizArt, @Khareem Sudlow