USDC: The digital dollar for the global crypto economy

TL;DR: Coinbase believes crypto will be part of the solution for creating an open financial system that is both more efficient and more equitable. We co-founded the Centre Consortium in 2018 to invest in the build of USDC, and since then it has become the second largest stablecoin by market capitalization. We firmly believe that USDC will be a key component of a new financial paradigm, as it helps to bridge the gap between the worlds of crypto and fiat.

Stablecoins provide a bridge between the traditional financial system and the cryptoeconomy, allowing fiat currencies to exist in a form that can move more freely and more efficiently on blockchains. Unlike conventional payment methods, stablecoin payments require no centralized intermediary. We believe that stablecoins — USDC, most importantly — will be the foundation of a new era of innovation in financial services.

Why USDC?

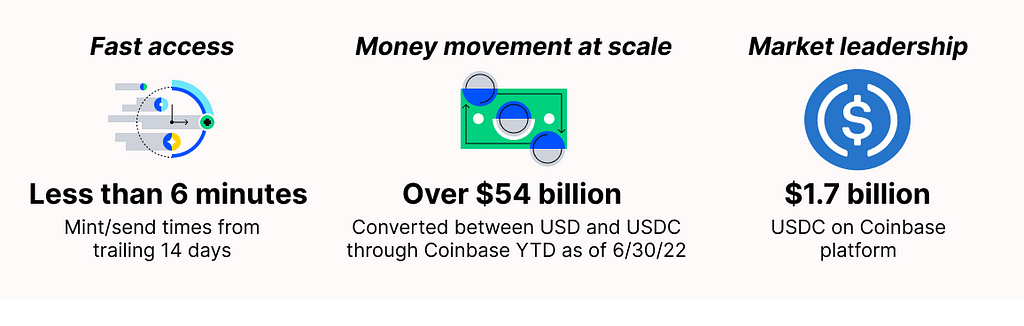

Back in 2018, we co-founded the Centre Consortium to create the most trusted and reputable digital dollar. Stablecoins have many uses, from trading in digital asset markets to making payments. We launched USDC as a way to simplify these processes so that anyone can participate, continuing to drive towards our goal of economic freedom. Since then, we’ve built a suite of supporting products and systems to enable:

The value of many cryptocurrencies can fluctuate by the minute, so holding an asset like USDC gives buyers and sellers the stability and confidence they need in times of volatility. The stability of USDC comes from the fact that it is backed by one US dollar or asset with equivalent fair value held in accounts with US regulated financial institutions ¹— the defining feature of a fiat-backed stablecoin (as opposed to a crypto-backed or algorithmic stablecoin). These accounts are attested to and verified publicly by an independent accounting firm. The market capitalization of USDC increased from $28 billion to $54 billion between August 2021 and August 2022² which speaks to the confidence in USDC as a high quality liquid asset.

As an active member of the Centre Consortium, Coinbase is continuously developing our USDC product suite to grow the USDC ecosystem for our Retail, Institutional, and Developer customers.

The strength of USDC’s peg to the U.S. dollar, backed by high-quality reserves and with transparent disclosures, makes it a practical option for users who want to remain active in the crypto market during a downturn. We’ve already seen significant adoption of USDC for paired trading with other digital currencies on centralized exchanges, as well as usage in many DeFi protocols, where USDC’s reliability makes it an attractive collateral asset. The top four stablecoins, including USDC, account for almost 80% of centralized exchange trading volume.³ When we look to the future, there is even more untapped potential for stablecoins like USDC within mainstream commercial use cases:

- Increased financial inclusion — Globally, 1.7 billion people do not have access to a bank account.⁴ In the United States, 5% of adults are unbanked and 13% are underbanked.⁵ USDC and other stablecoins have the potential to broaden access to financial services through reduced costs and increased efficiency. All that is required to participate in the crypto economy is internet access via smartphone or computer.

- Faster and cheaper global money transfer — Transfers for stablecoins like USDC can be settled in under 30 minutes or less, whereas international transfers can take multiple business days. Cross-borders transfers can also be prohibitively expensive using conventional methods. Coinbase supports cross-border transfers of digital assets on our platform, including USDC (and other stablecoins). These cross-border transfers can be made at far lower cost than the global average cost of cash transfers, which is closer to 7%.⁶

- On-ramp to web3 — We believe USDC and other stablecoins will play an important role as the fiat onramp into the new web3 digital ecosystem, which will give users more control over their information, data, and digital footprint. DeFi protocols are emerging as part of this decentralization and have the potential to improve economic efficiency in areas like trading, insurance, automatic payments, saving, lending, and borrowing.

- Payments to merchants — Stablecoin payments, including those for USDC, can be conducted on a public blockchain that enables peer-to-peer transfers and users can settle transactions near-instantaneously without an intermediary bank or financial institution to facilitate. The flexibility and low cost of USDC payment methods can benefit consumers and businesses by increasing the competitive pressure on incumbent systems.

USDC for Retail Customers

Customers can feel confident in the value of their digital assets and have the opportunity to earn rewards on their USDC held at Coinbase. Fast processing and low transaction fees make USDC an ideal option for sending money anywhere in the world. USDC is being adopted across multiple chains, fostering more growth for application development. It is quickly becoming the standard stablecoin not just on Ethereum where it originally launched, but across the blockchain ecosystem from Layer 1 networks to side chains to Layer 2 networks. When users purchase USDC on Coinbase, there is no fee and they can earn rewards on their holdings.

USDC for Institutions

Digital stablecoins like USDC have rapidly become foundational assets for trading firms and market makers. Stablecoins allow market participants to price assets in a common currency, settle almost instantaneously, and retain assets on-chain with less exposure to volatility. Coinbase Institutional enables firms to utilize USDC to participate in global crypto asset markets. We provide multi-chain support on Coinbase Exchange, no fees for USDC custody on Coinbase Prime, easy acquisition, and one-to-one conversion between USD and USDC on both platforms.

USDC for Developers

USDC has quickly become the most popular stablecoin in the web3 ecosystem with approximately 30% of the total supply spread between DeFi platforms and Decentralized Exchanges. Coinbase enables developers to utilize USDC for their dapps, services and protocols with multi-chain support, no fees for custody, and a frictionless acquisition path. We’re actively building out our developer tooling and see USDC as a key offering for dapps looking to secure stable revenue, which is why we’ve enabled acceptance of USDC via Coinbase Commerce and conversion of USD to USDC via Coinbase Pay.

We firmly believe that USDC and stablecoins built with the same framework can be the foundation for innovation in a new era of financial services. Visit coinbase.com or review our stablecoin whitepaper for more information on USDC. To start using a more efficient form of dollars, log into your Coinbase.com, Coinbase Prime, or Coinbase Exchange account. If you are an institutional client, you can also review our USDC overview documentation for Coinbase Prime and Coinbase Exchange.

1 https://www.centre.io/usdc-transparency

2 Coingecko, USDC Market Capitalization Chart.

3 Data sourced from CryptoCompare, as of 30 June 2022

4 a16z, State of Crypto (17 May 2022)

5 Board of Governors of the Federal Reserve System, Report on the Economic Well-Being of U.S. Households in 2020, (May 2021)

6 BIS, The journey so far: making cross-border remittances work for financial inclusion (15 June 2022)

USDC: The digital dollar for the global crypto economy was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

OhNoCoinbase via https://www.ohnocrypto.com/ @Coinbase, @Khareem Sudlow