Bitcoin Dipped to Weekly Lows on Minor Trading Volumes (Weekend Watch)

Although the trading volumes yesterday were quite low, similar to previous weekends, bitcoin still took a minor hit and fell to a weekly low.

Most altcoins are also slightly in the red on a daily scale. QNT is among the very few exceptions, being up by double digits.

Bitcoin Dipped Towards $19K

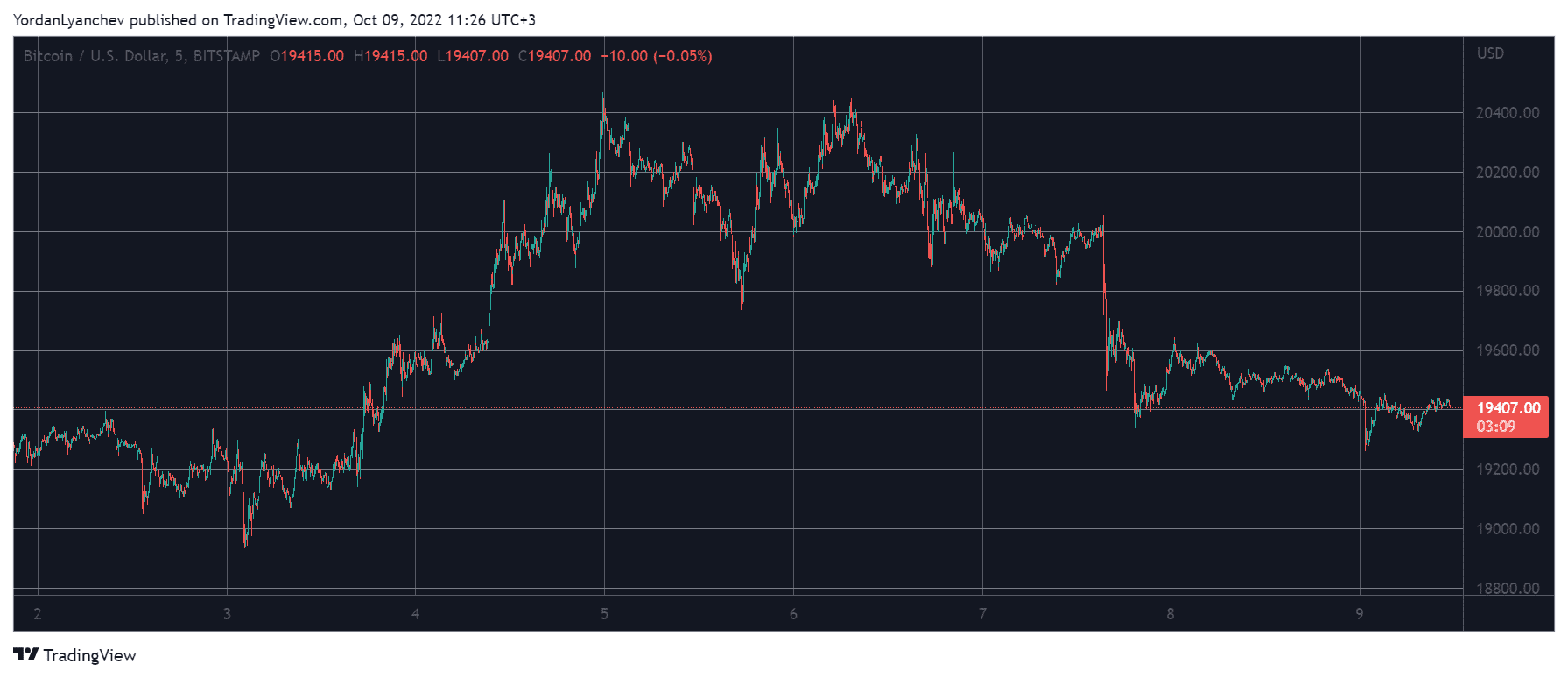

The primary cryptocurrency was flying higher earlier this week when it pumped to $20,500 – the highest price tag it had seen in about three weeks. However, the US job reports changed the tides, even though they provided better-than-expected numbers.

BTC reacted with an immediate price drop of around $1,000 – from over $20,000 to $19,300. The asset bounced off initially and jumped to north of $20,000 once again, but the bears came back to play and drove it south.

As such, bitcoin slipped to $19,500 yesterday and spent most of the day there on low trading volumes. Hours ago, though, it dipped below $19,300, which became its lowest price tag since October 3.

As of now, it stands a few hundred dollars upwards, but its market cap is still below $375 billion. Its dominance over the alts has calmed at 39.6%.

Alts With Minor Losses

The larger-cap altcoins have not enjoyed the past several days, except for Ripple, which was yesterday’s best performer. Although XRP is slightly in the red now, it has remained above $0.5 as it’s up by 9% weekly.

Ethereum has defended the $1,300 level, despite a minor daily retracement. Binance Coin, Cardano, Solana, Dogecoin, Polkadot, Shiba Inu, Polygon, Tron, and Avalanche are also with minor daily losses.

Given the aforementioned low volumes in the entire crypto market, most alts are also sitting quietly. QNT is the only apparent exception, following a 12% surge to over $155.

The cumulative market cap of all crypto assets stands still as well at $940 billion.

The post Bitcoin Dipped to Weekly Lows on Minor Trading Volumes (Weekend Watch) appeared first on CryptoPotato.

OhNoRipple via https://www.ohnocrypto.com/ @Jordan Lyanchev, @Khareem Sudlow