Ethereum’s staking demand surges ─ Yield annual rate 5%, waiting time about 1 month | coindesk JAPAN | Coindesk Japan

Crypto investors looking to hold Ethereum (ETH) for yield will have to wait nearly a month before being set up as validators on the Ethereum network.

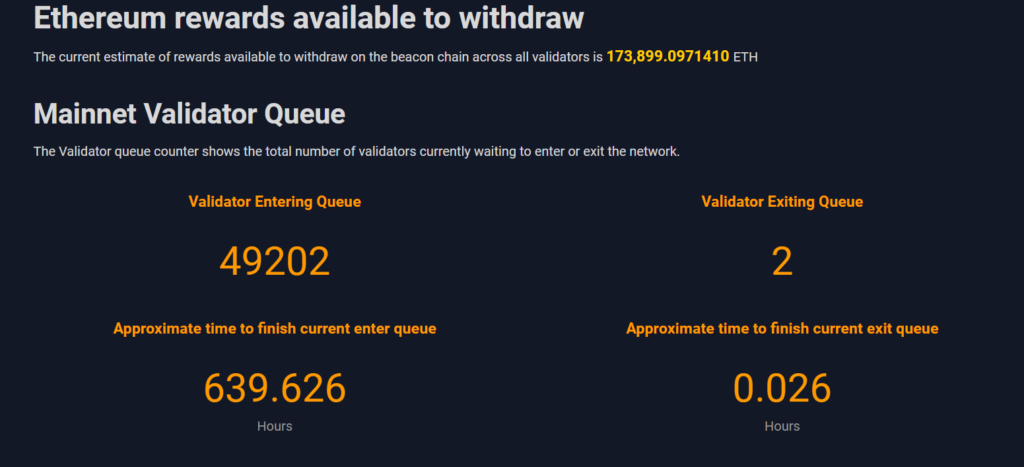

According to data from two sources, Ethereum’s staking latency spans 640 hours, or about 26 days. On the other hand, it takes only 0.026 hours, or 1.5 minutes, to exit the network.

Validators are entities in proof-of-stake blockchains like Ethereum that process transactions and contribute to maintaining the overall security of the network. As of May, data showed that nearly 50,000 validators were waiting in “queues” to enter the network.

The data shows the high demand for joining the network and earning close to 5% annual yield. Such demand is likely coming from large holders who do not want to cash out their ETH and want passive income from their ETH holdings.

Some market watchers believe that these validators are new market entrants and stakers who previously unstaked ETH from the network to test whether the process worked seamlessly and are now re-entering. It states that both may be mixed.

“In the immediate aftermath of the Chapella upgrade, there may have been a significant amount of demand pressure put on by stakers who were locked up for over 18 months and wanted to get out of their staked ETH positions,” according to staking protocol Alluvial. Co-founder Matt Leisinger explained.

“As all of these stakers have let go of their positions, the pressure has since subsided and there is now increased demand for staking from what can be assumed to be new participants coming to the market for the first time,” Reisinger added. rice field.

Shappella is a portmanteau of Shanghai and Capella, two major Ethereum network upgrades that occurred simultaneously on April 12, giving investors the freedom to withdraw their staked ETH for the first time. It became possible.

Staking deposits have surged in recent weeks. More than 200,000 ETH were deposited into the network last week, according to data from on-chain analytics tool Nansen, with deposits surpassing withdrawals for the first time since the Chapela last month.

With these additions, the number of ETH locked for staking purposes has exceeded 19 million, or about 15% of the total supply in circulation.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: CoinDesk

|Original: Ether Holders Embrace Near Month-Long Wait for Staking ETH

The post Ethereum’s staking demand surges ─ Yield annual rate 5%, waiting time about 1 month | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

OhNoCryptocurrency via https://www.ohnocrypto.com/ @Damien Martin, @Khareem Sudlow